Yield management best practices for publishers choosing to migrate to a first price auction

(Part 3 of a 5 part series on Best Practices for First Price Auctions)

Open auction floor management

First, let’s level set on what open auction floor optimization is in a first-price world. In a first-price auction:

- The concept of bid reduction does not exist anymore

- Floors theoretically only impact fill rate

The illustration below shows the difference between an auction pay-off in a second-price auction model and in a first-price auction model. In a first-price auction model, the clearing price is either the winning bid value if your floor is lower, or 0 if your floor is higher.

- If only those two assumptions are true, then the theoretically optimal strategy in terms of revenue would be to have…. no floors at all!

But auctions and bids are a dynamic environment. In other words, changing the floor value applied to your inventory most likely has an impact on buyer bidding behavior. Hence, the concept of optimizing your floor strategy in a first-price auction model is still valid! For instance:

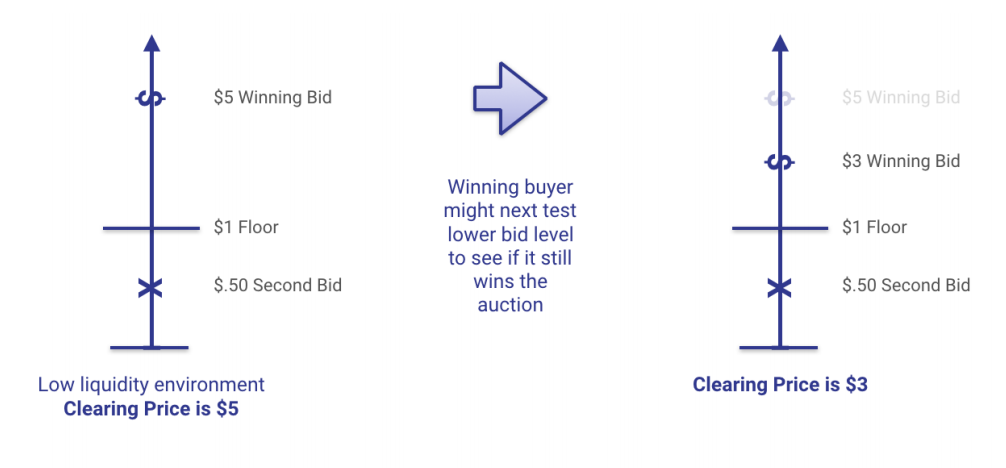

- Setting floors too low in a non-competitive environment might encourage buyers to lower their bids and drive your overall yield down

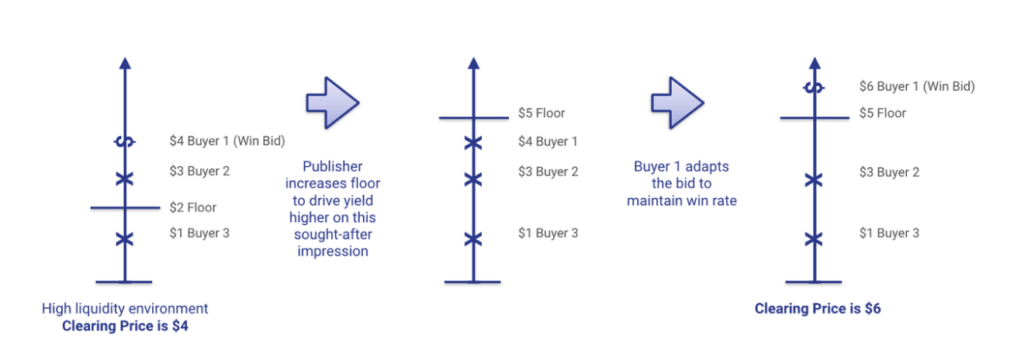

- Increasing floors on sought-after audience and/or content could potentially increase yield, as most buyers are monitoring closely their win rate and adapt their bid level accordingly when this rate is off-target

Floors are therefore still needed:

- In zones of low liquidity (like in a second-price auction model) to make sure winning buyers are not incentivized to decrease their bid level

- To prevent any theoretical “gaming opportunity” (e.g. all buyers agreeing to reduce their bids by X% – maintaining their respective win rate but at a lower CPM, resulting in lower revenue for the publisher)

Naturally comes the question: What is the optimal floor strategy in a first-price auction model? Understanding the dynamics between buyer bids and floors in a first-price auction world requires data modeling and bid prediction – Adomik data science team is working on the topic and we will publish findings shortly.

Also note that we are currently living in a turbulent zone where only part of the auctions are run in a first-price model (and even in those, not all buyers are participating using a “first-price auction bidder”). Therefore, most urgent actions to be taken are:

- carefully monitor performance (CPM and revenue) by demand partner

- identify abnormal patterns

- compare them to market trends

- last but not least, study your bid-level data to detect illiquid (and therefore at risk) parts of your inventory.

(Adomik Analyze and Unify products are designed to help you on these pressing topics)

By the way, floor optimization is still needed, more than ever, in all monetization partners running second-price auction!

Next up is PMPs, so stay tuned!

<Previous – Best Practices in First Price Auctions Article – Next >